Cutting the cost of high-quality research

Equilytics proprietary software, saves investment firms hours of analyst time

Through instant identification of the most relevant, contextually important information across thousands of documents

Find out more

Fundamental Data Analysis Software

Intelligent investment decisions rely heavily on taking the time to pick through a vast array of company data to find a small set of critical details. Unearthing specific data from where it is hidden inside corporate, conference and earnings call transcripts is a laborious process, eating up hours of analyst time which could be put to better use.

Our proprietary software, does the job of an analyst, reviewing thousands of disparate corporate data sets to pinpoint the specific, relevant, contextual information or prioritise the most relevant documents within seconds, saving hours of reading time.

Core Value

Equiltics data mining software powered by FactSet, that can instantly review thousands of corporate documents and transcripts to extract contextual information. With Equilytics finding your data, you will speed up your investment process and dramatically reduce the reading time required to make sound investment decisions.

Tailored Context Mapping

Equilytics can be tailored to match your investment strategy. We work with you to develop a unique Context Map that mirrors your investment strategy in both theme and context. We can evaluate any set of corporate information that could be of value to you in seconds, and find the most relevant content. This will streamline your investment process, and cut both the cost, and the time it takes to find the relevant research to power your investment decisions. It's time to turbo-charge your anlysts.

What We Deliver

Tailored Approach

We build a unique Context Map that reflects your investment strategy and provides only the most relevant timely data for your organisation, mapped to your investment assessments.

Customised For You

We can adapt our software so that it works best for each client, adding in functionality and drawing from the most appropriate dataset for each client.

Trusted Partner

We build a long-term relationship with each client, refining and adjusting Context Maps, so that we continue to meet your needs no matter what changes you might make to your investment strategy.

Our Team

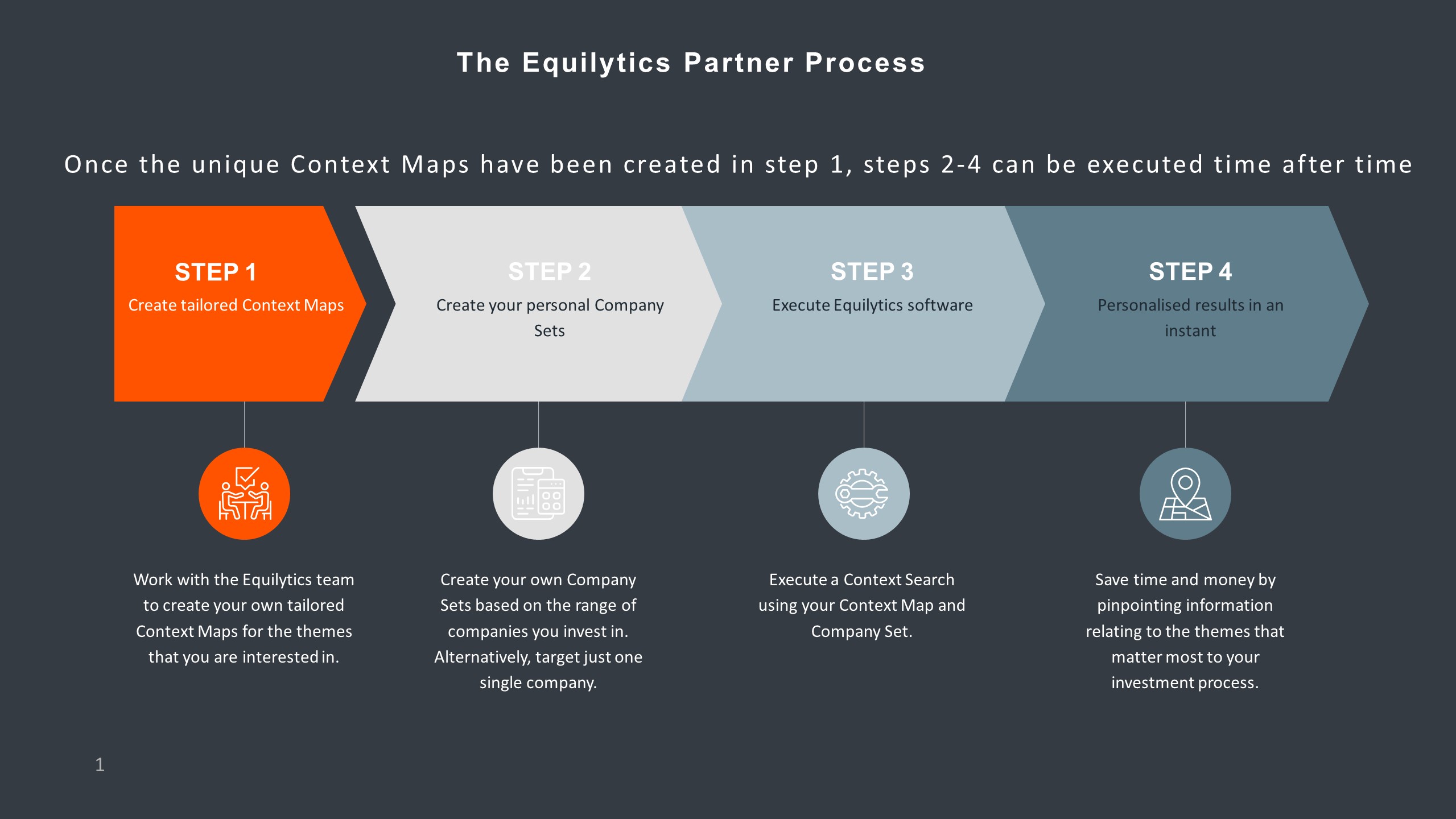

How It Works

Equilytics Enhances Your Investment Process

The best armies have the best weaponry. Equip your analysts with Equilytics, a powerful research tool, that can pinpoint the most relevant sections of content from amongst an enormous volume of fundamental corporate transcript data within seconds.

Equilytics Jargon Defined

Context Map - An investment theme that is important in your company analysis. For example - Investment in innovation.

Company Set - A user configured set of companies across which the context map will search for results.

Get In Touch

Contact Details

Contact us today to discuss using Equilytics.